The structure of the Indian pump market is highly fragmented. A considerable number of small and medium-sized companies characterize it.

Pumps are essential in almost all sectors of the economy, including infrastructure and agriculture. In this blog, we will discuss the growth opportunity in the pump segment.

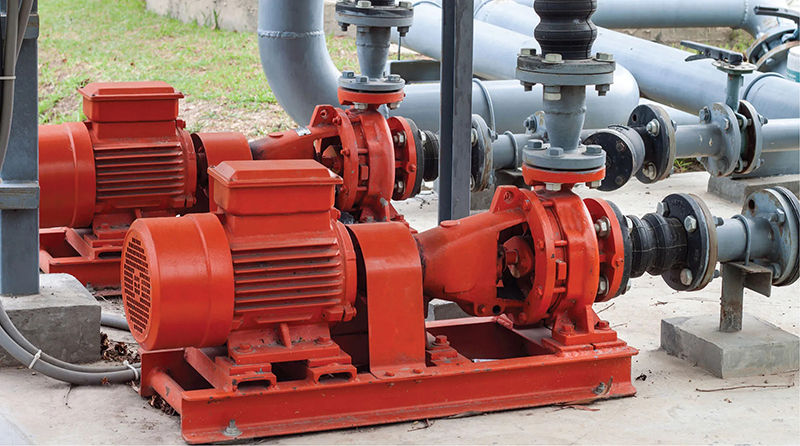

India’s pump industry is a significant contributor to the country’s growth. The two primary uses of pumps are industrial and agricultural. Most industrial pumps are used in oil and gas, power generation, metals and mining, water and wastewater treatment, and chemical industries. According to the type of operating principle, pumps are divided into categories such as dynamic pumps and positive displacement pumps.

The structure of the Indian pump market is highly fragmented. A considerable number of small and medium-sized companies characterize it. The market is highly competitive. The large Indian suppliers compete directly with the global players, and since they have a broad distribution channel, it is difficult for the global players to penetrate the market. Because of their relatively low prices, small regional suppliers threaten the extensive local and international suppliers regarding product prices. Only some of the larger suppliers can serve the industrial sector. Unorganized small suppliers account for almost half of the supply to the price-sensitive agricultural and residential segments. India’s principal pump manufacturing place is Coimbatore, Ahmedabad, and Rajkot.

The Size of the Market

Increasing urbanization, declining water tables, and various infrastructure improvement measures have contributed to the expansion of India’s pumping sector in recent years. As a result, the market has evolved significantly. This trend is responsible for growth in domestic infrastructure construction and other water-intensive businesses. However, due to rising product prices and pandemic-like conditions, the market has seen a decline in growth over the past year. According to the Southern India Engineering Manufacturers Association, the pump industry witnessed a drop of around 20 percent in volume during 2021-22. It was mainly due to the increase in manufacturing costs by about 45%. As a result, the profits of all companies were affected as manufacturers were able to raise the prices of end products by only 25 percent.

Segmentation

About 95 percent of pumps sold worldwide are dynamic pumps, also called centrifugal pumps. Positive displacement pumps account for the remaining 5 percent of the market share. Single-stage radial-flow and submersible pumps account for about 70 percent of all centrifugal pumps. Rotary positive displacement pumps account for the majority of positive displacement pumps. While agriculture and building services account for 46 percent of the market (by value), the overall infrastructure sector accounts for the remaining 54 percent of demand.

Small and medium-sized companies find it challenging to compete in the technologically advanced industrial sector of the pump industry. Domestic pump manufacturers meet about 90 percent of market demand, while imports account for about 10 percent. To meet local demand, both Indian and foreign companies are active.

Concentration on Energy Efficient

The topic of energy efficiency has recently attracted widespread interest, including from pump manufacturers. It inspired them to improve their products with environmentally friendly design elements. As a result, despite some obstacles, the country’s pump manufacturers continuously work to improve production, quality, and service.

Current statistics show that energy-efficient pump units with asterisks have an average efficiency of 40-45 percent, while inefficient pump units without asterisks have an average efficiency of 25-30 percent. The Indian Pump Manufacturers Association estimates that savings of 20 percent could be achieved simply by replacing low-performing pumps with those with higher ratings.

The Use of Technology

Thanks to the continuous efforts of the central and state governments, the use of solar pumps has increased in the country. A study by the Ministry of Renewable Energy, a total solar capacity of 816 MW has been added by December 2022 through the installation of stand-alone solar pumps under Component B and solarization of existing grid-connected agricultural pumps under Component C under PM-KUSUM or the Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan program.

The installation of approximately 0.47 million autonomous solar pumps in the country has reduced diesel consumption by 325 million liters per year by December 31, 2022. The total solar capacity installed under the PM-KUSUM program is estimated to reduce carbon dioxide emissions by about 0.53 million tons annually.

The Main Players in the Pump Segment

The pump sector is undergoing change and consolidation worldwide. As a result, major foreign companies seek to expand their presence in India as they see development opportunities there. As a result, major foreign companies are entering the Indian market and trying to expand their influence. Leading international manufacturers of industrial pump systems, including KSB Pumps, Grundfos Pumps, Wilo AG, and Flowserve Corporation, already have a presence in India.

In the pumps market, several large Indian companies, including Kirloskar, CRI Pumps, Texmo Industries, Jyoti Pumps, WPIL Limited, and Flowmore, have a strong presence and offer customized solutions for various market segments. On the other hand, several mid-sized competitors, including Shakti Pumps, Falcon Pumps, Roto Pumps, Kishor Pumps, Sharp Pumps, Suguna Pumps, and Aqua Sub Pumps, hold a significant share of the market.

Challenges in the Pump Industry

A small number of large manufacturers have controlled the entire industry. Small and medium manufacturers have a relatively low penetration rate. Nevertheless, the large number of SMEs offering affordable pumping solutions has put enormous pressure on the market share of the larger companies in the household and agricultural sectors. In addition, the supply of cheap electricity to farmers is a barrier to adopting energy-efficient technologies. Another problem market participants need help with is increased input prices, which has led to higher expenses and lower profit margins. SMEs have been particularly affected by this. Last year also saw a rise in manufacturing costs for products in the pump sector.

The Growing Opportunity

The growth opportunities are enormous, given the government’s increased emphasis on water management and India’s small 3 to 5 percent share of the global pump market. Several Indian pump manufacturers have begun to enter the international market. However, there is an urgent need to realign distribution networks to optimize costs, better understand customer needs and improve services. In the future, emphasis should be placed on creative marketing approaches and energy-efficient technologies. The industry expects demand to improve this year as raw material prices stabilize and demand increases. In addition, the industry needs to explore high-quality pumps.

The primary end users in India are the water and wastewater, chemical, pharmaceutical, construction, food and beverage, and mining industries. The popularity of industrial pumps in India is expected to increase due to the growing emphasis on products that are energy efficient in the wastewater sector, along with the growth in pharmaceutical production and rapid expansion, the rise of large-scale housing projects, and the increase of infrastructure projects.

Comments are closed.